Investing in Bioprinting: Startups, Stocks, and Tokens to Watch

Investing in Bioprinting: Startups, Stocks, and Tokens to Watch

Including VC trends, public companies, and blockchain-based IP marketplaces

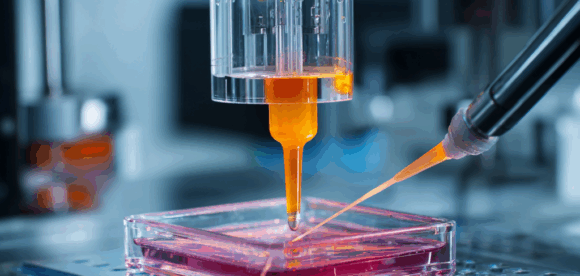

Bioprinting—using additive manufacturing to print cells, tissues, and eventually organs—is moving from sci-fi to an investable frontier. Capital is flowing into next-gen tissue therapeutics, 3D cell-culture platforms for drug discovery, and enabling hardware/bioinks. At the same time, decentralized-science (DeSci) projects are tokenizing research IP and opening new on-ramps for retail investors.

Below is a practical, investor-ready overview.

1) The market backdrop (why now)

Independent market trackers expect mid-teens CAGRs this decade, with 2024–2025 market sizes in the $2.5–$3.0B range and long-run potential to the $8–12B band by the early-to-mid 2030s—driven by pharma’s need for better preclinical models, advances in materials/bioinks, and early clinical moves in regenerative medicine. BioSpace+2Coherent Market Insights+2

In parallel, macro biotech VC is recovering, but with tighter diligence and more strategic partnering with big pharma—good news for platform companies that de-risk via co-development. The Wall Street Journal

2) Venture trends & private leaders

A. Tissue-therapeutics platforms (highest upside, longer timelines)

-

Aspect Biosystems (Canada) — Developing bioprinted tissue therapeutics; inked a potentially >$2.6B collaboration with Novo Nordisk for diabetes/obesity and closed a $115M Series B (Jan 2025) to accelerate programs. This is the category’s flagship BD signal. aspectbiosystems.com+3GeekWire+3aspectbiosystems.com+3

B. Drug-discovery tools (faster revenue, pick-and-shovel angle)

-

Inventia Life Science (Australia/US) — RASTRUM high-throughput 3D cell-culture/bioprinting platform; raised ~US$25M Series B and expanded in the U.S. This is a nearer-term revenue play supplying pharma/academia. VoxelMatters+2Drug Discovery Trends+2

C. Enabling materials & collagen

-

CollPlant (Israel, Nasdaq: CLGN) — Recombinant human collagen (rhCollagen) for tissue repair/bioprinting and aesthetics; active R&D and updates through 2025. Materials/IP moat can command strategic interest. CollPlant Biotechnologies Ltd.

Deal flow note: Sector trackers show a steady drumbeat of early-stage rounds in 2024–2025 across EU/NA, with ~$200M+ disclosed across at least nine bioprinting startups in the recent 12–18 months. Expect more corporate VC and public-private grants. Quick Market Pitch+1

3) Public equities with bioprinting exposure

-

3D Systems (NYSE: DDD) — Beyond industrial AM, DDD runs a Regenerative Medicine division with United Therapeutics targeting organ scaffolds (notably lungs). In June 2025, the company announced its bioprinting tech helped enable an FDA-approved peripheral nerve repair indication—an important validation step for printed biologics/biomaterials. Watch progress/milestones (and associated legal disclosures) around the United Therapeutics partnership. GlobeNewswire+3investor.3dsystems.com+3Stock Titan+3

-

BICO Group (Nasdaq Stockholm: BICO) — A roll-up of life-science tools (CELLINK, etc.) spanning bioprinters, bioinks, and lab automation. 2024–2025 corporate actions (divestments, bond repurchases, strategy “BICO 2.0”) point to portfolio refocus; it remains a liquid public proxy on the bioprinting tools stack. BICO – The Bio Convergence Company

-

Organovo (Nasdaq: ONVO) — Pivoted toward using 3D human tissues to discover/develop therapeutics (e.g., IBD models), with periodic business updates in 2025. High risk, clinical-stage timelines, but a direct pure-play. ir.organovo.com+2GlobeNewswire+2

How to think about the basket: DDD = diversified AM with a regenerative kicker; BICO = tools/platform exposure; ONVO = pure-play biotech risk/reward. Track catalysts (FDA interactions, BD deals, capital runway) before sizing positions. investor.3dsystems.com+2BICO – The Bio Convergence Company+2

4) Tokens & blockchain-based IP marketplaces (DeSci)

A. IP-NFTs and IPTs (new rails for biotech IP)

-

Molecule pioneered IP-NFTs—on-chain assets that encapsulate research IP/data rights—and IPTs (fungible “IP pool” tokens) that let communities co-fund and govern early-stage biotech assets. Think: programmable licensing + community-governed development. molecule.xyz+1

-

VitaDAO (token: VITA) funds longevity research using Molecule’s framework. 2025 saw further activity (e.g., IPT launches/oversubscription); VITA is actively priced on major trackers. This is the most visible DeSci asset for retail. Caveat: crypto risks apply; token ≠ equity claim on IP revenues unless explicitly structured. AInvest+2CoinGecko+2

-

ResearchHub (token: RSC) incentivizes open science contributions; token economics and circulating supply are evolving—understand dilution/treasury unlocks. ResearchHub+2CryptoRank+2

-

LabDAO is building a decentralized network for shared lab tools/services; raised ~$3.6M seed and explores token-gated access/governance for lab capacity—useful scaffolding for open bioprinting R&D. Tokenist+2TDE+2

Thesis: DeSci rails won’t print organs—but they can fund and license the IP that eventually does. If you participate, treat tokens as governance/utility with event-driven upside (grants, IPT launches, licensing news), not revenue-backed securities—unless explicitly stated in legal docs. Molecule

5) How to build an exposure strategy

A. Core (lower beta):

-

A small equity basket in DDD + BICO, sized for volatility; add CLGN or ONVO as a satellite if you can underwrite the clinical risk. Track quarterly reporting and BD pipelines. ir.organovo.com+3investor.3dsystems.com+3BICO – The Bio Convergence Company+3

B. Growth (platform optionality):

-

Follow private leaders’ BD milestones and grant wins (e.g., Aspect’s Novo Nordisk deal, Canada funding) and evaluate secondary exposure via crossover rounds or later IPOs. GeekWire+1

C. Frontier (high beta / thematic):

-

Small, speculative allocations to VITA or RSC if you actively follow DeSci governance, IPT offerings, and token economics. Consider staking/participation rather than passive holding. CoinGecko+2CoinMarketCap+2

6) Due-diligence checklist (actionable)

-

Clinical & regulatory path

-

What class of product is it (research tool vs. therapeutic)? Any FDA interactions or predicate approvals (e.g., nerve repair indication aided by bioprinting tech)? investor.3dsystems.com

-

-

Partnering signals

-

Big-pharma co-development (e.g., Novo Nordisk x Aspect) de-risks science and commercialization. Size and structure of milestones matter. GeekWire

-

-

Unit economics & adoption (for tools)

-

Printer + consumables model, installed base growth, and recurring bioink/media revenue (BICO/CELLINK, Inventia). BICO – The Bio Convergence Company+1

-

-

Materials/IP moats

-

Proprietary bioinks (e.g., rhCollagen) and patents around printing modalities can sustain pricing power. CollPlant Biotechnologies Ltd.

-

-

Governance & token risks (for DeSci)

-

Token supply schedules, treasury control, IP-NFT license terms, and whether IPTs entitle holders to any revenue share. molecule.xyz

-

7) Risks

-

Technical: Vascularization, immune compatibility, and functional integration remain hard; timelines can slip.

-

Regulatory: New pathways (printed tissues/devices) mean evolving guidance and milestone uncertainty. investor.3dsystems.com

-

Financing: Platform trials are capital-intensive; watch cash runways and contingent milestone timing. The Wall Street Journal

-

Token volatility & legal ambiguity: Governance tokens can be highly volatile and may not convey financial rights. Read the docs. Molecule

8) Quick watchlist

Private/VC: Aspect Biosystems; Inventia Life Science. aspectbiosystems.com+1

Public: 3D Systems (DDD); BICO Group (BICO.ST); CollPlant (CLGN); Organovo (ONVO). ir.organovo.com+3investor.3dsystems.com+3BICO – The Bio Convergence Company+3

DeSci/Tokenized IP: Molecule (IP-NFT/IPT rails); VitaDAO (VITA); ResearchHub (RSC); LabDAO. Tokenist+4molecule.xyz+4molecule.xyz+4

Crypto Rich ($RICH) CA: GfTtq35nXTBkKLrt1o6JtrN5gxxtzCeNqQpAFG7JiBq2

CryptoRich.io is a hub for bold crypto insights, high-conviction altcoin picks, and market-defying trading strategies – built for traders who don’t just ride the wave, but create it. It’s where meme culture meets smart money.

Categories

Recent Posts

- The DAO of Design: Community-Owned Innovation in the 3D Printing Space

- 3D Printing + AI: Smart Design, Optimization & Automated Repairs

- Investing in Bioprinting: Startups, Stocks, and Tokens to Watch

- The 3D Printing Industry – 3D Printing Meets Blockchain: Tokenizing the Future of Manufacturing

- Robots, Printers, and Tokens: The Rise of Crypto-Powered Manufacturing

Recent Comments

- 3D Printing Start Up Incubator Questions | International toolkit on Slide Show Presentation About Questions Start Ups and Entrepreneurs Need to Ask Before Starting 3D Printing Businesses

- 3D Printing Start Up Incubator Questions | 3D Printing Ad Agency on Slide Show Presentation About Questions Start Ups and Entrepreneurs Need to Ask Before Starting 3D Printing Businesses

- 3D Printing Start Up Incubator Questions | 3D Printing Blog on Slide Show Presentation About Questions Start Ups and Entrepreneurs Need to Ask Before Starting 3D Printing Businesses

- 3D Printing Start Up Incubator Questions | 3D Printing PR Firm on Slide Show Presentation About Questions Start Ups and Entrepreneurs Need to Ask Before Starting 3D Printing Businesses

- 3D Printing Start Up Incubator Questions | 3D Printing Bank on Slide Show Presentation About Questions Start Ups and Entrepreneurs Need to Ask Before Starting 3D Printing Businesses